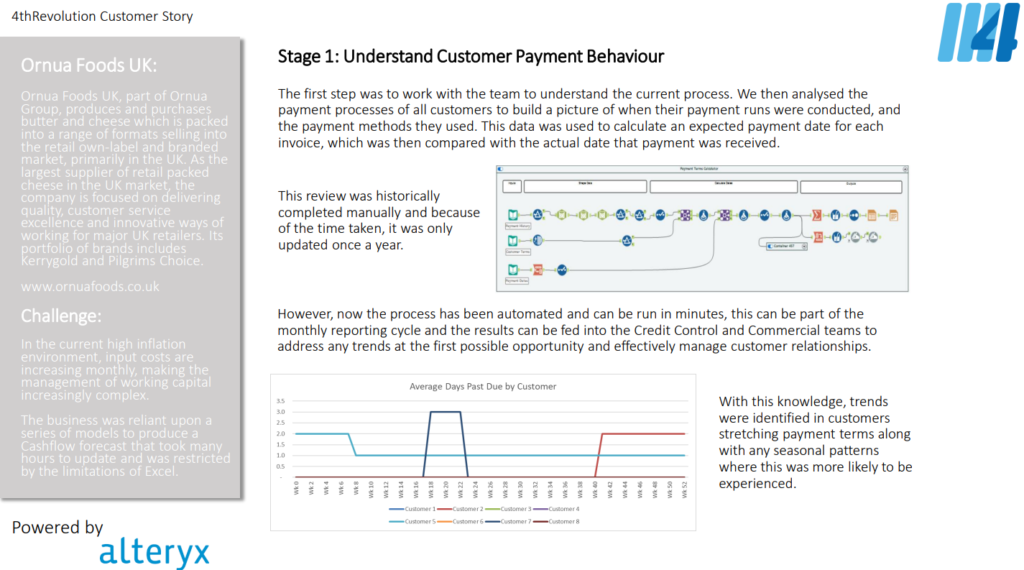

We recently worked with Ornua, using Analytical Process Automation to enable their customer payment behaviour to be understood. This has enabled future payments to be modelled with greater accuracy and in turn enabled funding requirements to be predicted and actively managed.

The Challenge – In the current high inflation environment, input costs are increasing monthly, making the management of working capital increasingly complex. The business was reliant on a series of models to produce a cashflow forecast that took many hours to update and was restricted by the limitations of Excel.

Our Approach – Whilst automation of Excel based processes is at the core of what we do, our experience as Chartered Accountants and Exec level leaders means we understand the processes quickly, reducing delivery costs, expediating delivery times and delivering solutions that add value and harness the power of your data.

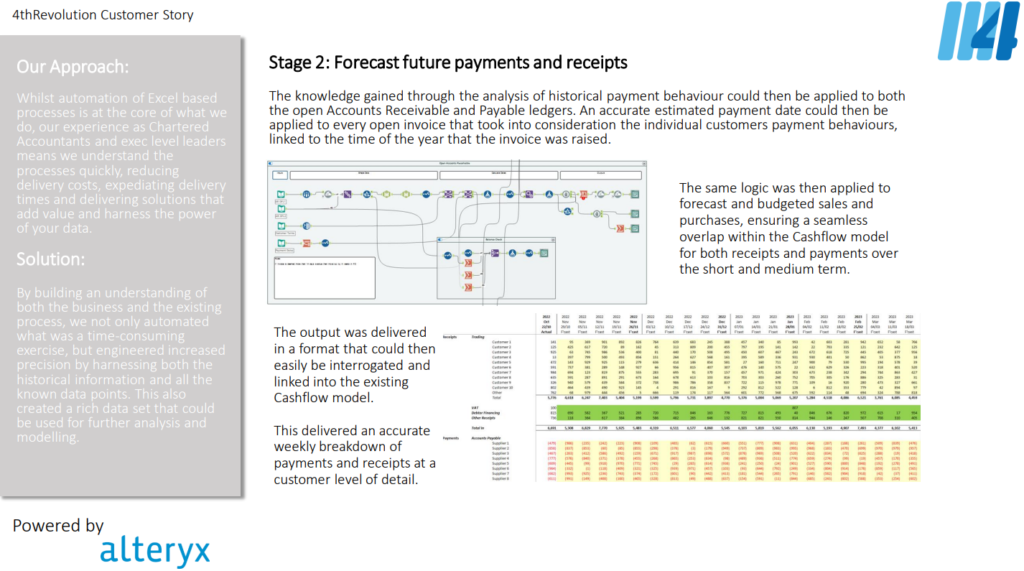

The Solution – By building an understanding of both the business and the existing process, we not only automated what was a time-consuming exercise, but engineered increased precision by harnessing both the historical information and all the known data points. This also created a rich data set that could be used for further analysis and modelling.

Benefits – In addition to having a model that has increased accuracy, it can now be refreshed on demand, as the time taken as a result of the automation is minimal. The Finance Team can instead utilise the time saved to better understand the cash position and support the business decisions needed to proactively influence the future cash position.

Results – The forecast cash position is now more accurate and up to date, enabling the finance teams to respond proactively and work with the business to manage any future risks and opportunities.