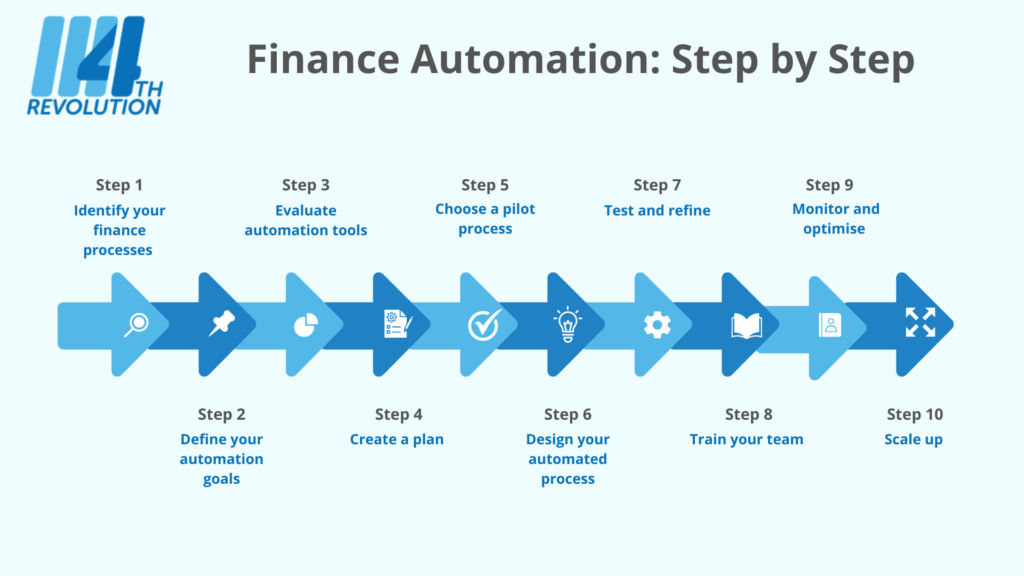

Automation within Finance Teams is key to improving efficiency, significantly reducing the time and effort required for repetitive tasks and increasing accuracy. There are normally many Excel process in Finance departments, that can be automated. We’ve produced a step-by-step guide to help you through the automation journey.

- Step 1 – Identify your finance processes: Begin by identifying the finance processes that are most time-consuming, error-prone and repetitive. This could include tasks such as data entry, account reconciliation and report generation. We offer a free workshop session with your team to identify the key processes that would benefit from automation, using our experience of Finance processes, Alteryx and what have given the biggest benefits to other clients.

- Step 2 – Define your automation goals: Once you have identified the processes to automate, define your automation goals. This could include increasing efficiency, reducing errors, improving compliance and freeing up time for more strategic work.

- Step 3 – Evaluate automation tools: Research and evaluate automation tools that can that can help you achieve your automation goals. Look for tools that are easy to use, integrate with your existing systems, and have a strong track record of success. We believe that Alteryx ticks all those boxes, with the advantage that it can be used throughout your organisation in various teams to automate manual processes and increase the ROI.

- Step 4 – Create a plan: Create a plan for implementing automation in your Finance department. This should include a timeline, milestones and a budget.

- Step 5 – Choose a pilot process: Choose a pilot process to automate first. This could be a process which is particularly time-consuming, error-prone or repetitive.

- Step 6 – Design your automated process: Use your chosen automation tool to design an automated process for your pilot process. This may involve configuring workflows, setting up rules and triggers, and defining data inputs and outputs. We recommend using some consultancy time from an expert to help you implement your first pilot process. A consultant can build the pilot workflow for you or just offer advice and guidance to ensue best practice, whilst you are getting to grips with your new tool.

- Step 7 – Test and refine: Test your automated process and refine it as needed. This may involve tweaking rules and triggers, adjusting workflows or changing data inputs or outputs. Again, consultancy advice can be useful at this stage to save time and use knowledge and experience.

- Step 8 – Train your team: Train your finance team on how to use the automation tool and the automated process. Define which members of your team need to be trained in the automation tool, so require more detailed training and those who only need to use the process, so only need a working knowledge. We can provide training on Alteryx, passing on our best practice tips and knowledge to help a successful implementation.

- Step 9 – Monitor and optimise: Monitor your automated process and optimise as needed. This may involve monitoring performance metrics, collecting feedback from users and making adjustments based on insights.

- Step 10 – Scale up: Once your pilot process is successfully implemented, scale up automation to other finance processes.

So, think about those time-consuming processes you have in place now and the efficiencies you could generate by automating and start your automation project.

4th Revolution would love to help you on your journey and use our understanding of the power and capabilities of Alteryx within Finance teams, to help you deliver game-changing results. Please get in touch if you would like to chat through the features of Alteryx and how it may be able to help you.